Results 1 to 25 of 49

-

03-31-2014, 09:44 AM #1Banned

Reputation points: 306

Reputation points: 306

- Join Date

- Jan 2013

- Location

- New York City

- Posts

- 409

Brokers Get Big Commissions for Selling Entrepreneurs Costly Loans

Bloomberg Businessweek published a piece today which examines the impact of the broker and his / her influence on the end cost of funds to merchants. Have you all read the piece? What are your thoughts on it?

-

03-31-2014, 10:32 AM #2Sponsor

Reputation points: 3174

Reputation points: 3174

- Join Date

- Dec 2012

- Posts

- 116

Love the picture. Yikes!

-

03-31-2014, 10:41 AM #3Banned

Reputation points: 306

Reputation points: 306

- Join Date

- Jan 2013

- Location

- New York City

- Posts

- 409

-

03-31-2014, 10:45 AM #4

hahaha... i was thinking the same thing... i know a few stockbrokers that are doing juuuuust fine even tho there are PLENTY of online trading platforms... i dont see these online services killing broker business the way that article is implying it will.... sh*t, half the merchant i speak to daily either dont have a computer, or dont know sh*t about them... i did a deal with a guy that was EXTREMELY prudent, was very intelligent and flat said, he would rather deal with a human being than a computer, as a computer can not advise him on anything, but a person with 6+ years experience in specialty finance has a very good grasp on what is going on...

all this being said, the dialer warriors aren't going anywhere... god bless 'em!!!

-

03-31-2014, 10:58 AM #5Banned

Reputation points: 306

Reputation points: 306

- Join Date

- Jan 2013

- Location

- New York City

- Posts

- 409

-

03-31-2014, 11:17 AM #6

I had a similar experience as a broker. Many solid small business owners did not know how to use a computer or email. It wasn't uncommon for them to drive out to a Kinkos to fax documents. Some would send me their documents via USPS mail and not even copies but the originals so I'd have to photocopy them and then mail them back. And even beyond that I had merchants travel to my office to hand deliver their documents in person. This didn't happen a lot but it happened.

-

03-31-2014, 11:22 AM #7Sponsor

Reputation points: 3174

Reputation points: 3174

- Join Date

- Dec 2012

- Posts

- 116

Sean, 5 years ago, even 3 years ago I would agree with you. It used to be half the merchants didn't even have email addresses. But we see the environment changing. We just introduced e-signature for all of our documents. We are seeing 80-90% acceptance rates, and the biggest question we get is can I use e-signature on my mobile phone?

-

03-31-2014, 11:45 AM #8

-

03-31-2014, 11:46 AM #9Senior Member

Reputation points: 10944

Reputation points: 10944

- Join Date

- Oct 2013

- Location

- New York, NY

- Posts

- 1,203

The part I had the largest issue with in the article was the comparison of brokers in our industry to the "sub prime mortgage brokers" etc...I thought that was grossly exaggerated and in this article they made 17% commissions sound like the rule not the exception, which in my experience, it is.

-

03-31-2014, 11:55 AM #10

With respect to merchants not fully assimilating to the technology trends that permeate our everyday existence, I would have to agree with JBrown. It is an ever present reality that, baby-boomer are now in their retirement stages, and that the fastest growing sector of entrepreneurial growth is proliferating from Generation X; Tech savvy, and comfortable in their skin

-

03-31-2014, 11:59 AM #11

-

03-31-2014, 12:02 PM #12

Andy, there are funds that allow 17 point markup. That is only part of it. The OTHER part is the extra "professional service fees" attached (never a more gross misnomer if I ever heard one). Add those costs into the deal, and yeah, you are talking that kind of commission.

Businessweek is a pretty prominent magazine in the business world, also read by a politician or two. To all those naysayers who poo-poo on the chances of political curtailing on rampant surcharges I say "Repent, for the end is nigh!"

-

03-31-2014, 12:17 PM #13Senior Member

Reputation points: 10944

Reputation points: 10944

- Join Date

- Oct 2013

- Location

- New York, NY

- Posts

- 1,203

-

03-31-2014, 12:25 PM #14

-

03-31-2014, 01:56 PM #15Banned

Reputation points: 306

Reputation points: 306

- Join Date

- Jan 2013

- Location

- New York City

- Posts

- 409

-

03-31-2014, 02:49 PM #16

the sad part is...this can quickly unravel with a few merchant vs MCA interviews.

"The rep charged me this fee because he says this is how I get paid"

The MCA shows the 1099 they send the ISO for the commission payments.

Somebody is blatantly lying (thus committing fraud)

and so the snowball starts slowly rolling downhill

-

03-31-2014, 03:04 PM #17

Always the hater Chambo. Yes there are reps that make money on both sides but there are shops where account reps don't actually share in the commission the funder pays to the ISO.

An ISO getting 8 points may pay none of it to the account rep or a negligible portion leaving it up to the account rep to charge a fee for their services. That 8 points paid to the ISO itself might not even cover the cost of originating the deal, thus there potentially may not even be room to pay the account rep. But I get your point.

The industry is not uniform by any means. Some ISOs pay a small base salary and only pay a percentage of the closing fees to the account rep as commission. The points the ISO gets from the funder is used to offset the salary and pay for marketing and overhead.

-

03-31-2014, 03:50 PM #18

The cost of originating has continued to skyrocket...when I started doing PPC the cost per click was $4-$5...today the cost is closer to $25 per click...the commissions that brokers are paid simply does not even come close to covering the cost. In most cases the brokers need to charge a closing cost just to break even and don't make any real money until the deal is up for a renewal.

-

03-31-2014, 04:04 PM #19

I was doing lead gen. It lasted a year before I got priced out. There are a thousand companies on the web selling the same product and some have so much capital that they'll pay double or triple the market price just to squeeze you out. Competition is making the product more expensive not less expensive.

What people don't get is that business owners don't come to you, you have to go to them. With all this talk about alternative lending online, you'd think business owners would know where to go, yet every time I see a study performed, the results come back with business owners reporting they have no idea that alternatives to banks even EXIST. The last time a research group showed me figures, it was something like more than 70% of business owners who wanted money had no idea what to do after a bank declined them.

Almost every business owner I speak with has never heard of merchant cash advance or ondeck or lending club or any of it. They're in the business of running their business. They know what a bank is. After that, the information ends.

-

03-31-2014, 04:11 PM #20Banned

Reputation points: 306

Reputation points: 306

- Join Date

- Jan 2013

- Location

- New York City

- Posts

- 409

-

03-31-2014, 04:16 PM #21

-

03-31-2014, 04:19 PM #22

this is very true, but i notice when trying to market via B2B leads, where the merchants are MCA virgins it becomes a hard sell no matter how bad they want the money... lets face it 35-40 cents on the dollar isnt an easy thing for a biz owner to swallow... yes, there are 1,000,000 rebuttals for "thats way too expensive" and at that point your selling the value of your funder and renewals and possible lowered rates on the renewal, but it is not any easier... so yes, 70% of them have no idea they can get funds based on their past performance, but what percentage will actually close?

I mean, I price merchants right out of the gate... I ask them where their credit is, what their history looks like and so on and give them a range where I know they will end up. When marketing B2B I find this weeds out the "oh hell no, i had no idea it would cost this much" merchants immediately and increases the closing ratio dramatically... BUT, now your talking about a serious GRIND... how many dials/calls/conversations will it take in comparison to power dialing a UUC list?

-

03-31-2014, 04:23 PM #23

and all this talk about these online services... NOTHING, in ANY industry will EVER beat the human element... a computer isn't going to be as effective at closing a deal (if it can at all)... a computer won't be able to underwrite a deal and take into consideration something like a divorce ruining a guys credit... computers only go by numbers and statistics, a human being can and will look at a deal as a human being, and take things into consideration... but, again, this is just my opinion...

-

03-31-2014, 04:26 PM #24Senior Member

Reputation points: 99426

Reputation points: 99426

- Join Date

- Sep 2012

- Location

- New York, NY

- Posts

- 1,780

I used to power dial Hoovers business lists and it really was a colossal waste of time. It's no better than cold calling a phone book. Sure, 70% of these business owners don't know what an MCA is but that's because the majority of them have no need for it. The closing ratio was miniscule and sales agents would easily get burned out. If a merchant is really looking for an alternative to a bank loan, all they have to do is use Google. That's why PPC in our space commands such a premium.

There's a much better ROI for smaller ISOs in power dialing UCC lists and if you really want to go after the virgin MCA merchants, it's better to employ off shore call centers to do the grunt work for you. I've decided to leave the PPC and direct mail campaigns to the deep pocketed funders because I just don't have that type of financial bandwidth.Last edited by MCNetwork; 03-31-2014 at 04:32 PM.

-

03-31-2014, 04:33 PM #25

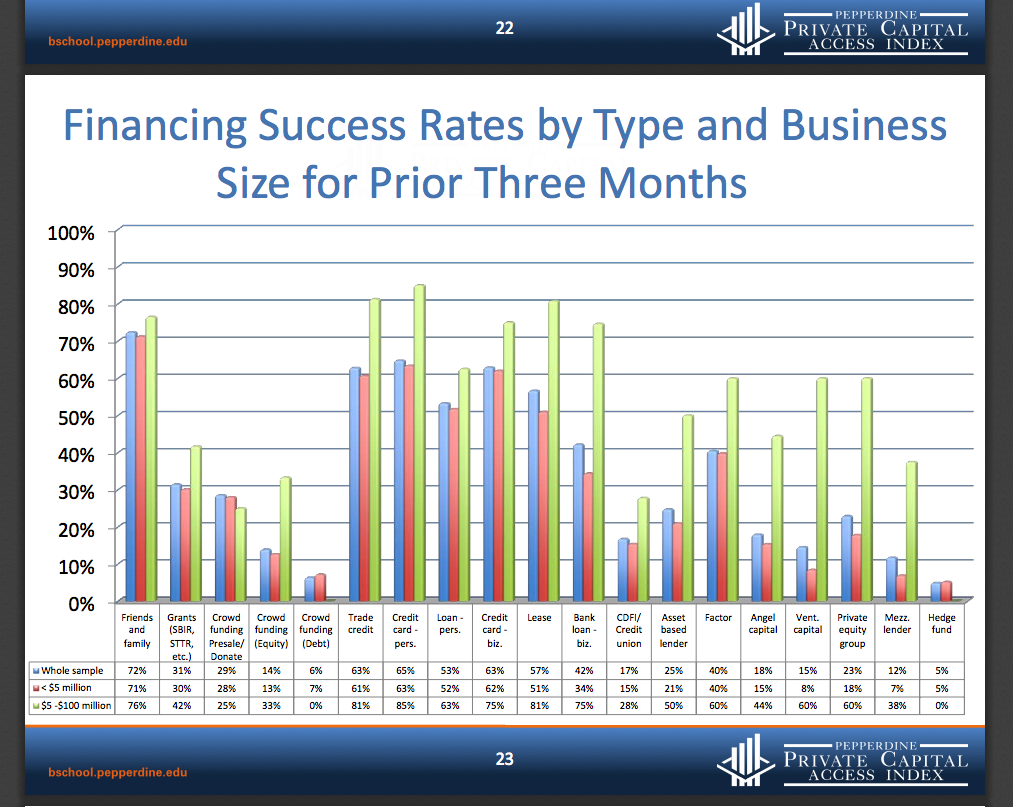

From this study by pepperdine university for Q4 2013: http://bschool.pepperdine.edu/applie...4_2013_pca.pdf

Similar Threads

-

Selling Merchant Cash Advances - How hard is it?

By mbradford101 in forum Merchant Cash AdvanceReplies: 61Last Post: 01-20-2017, 04:20 PM -

Where brokers go to make money

By bdshaw in forum Business LoansReplies: 4Last Post: 03-24-2014, 11:30 AM -

Where brokers go to make money

By bdshaw in forum Merchant Cash AdvanceReplies: 6Last Post: 03-18-2014, 05:00 PM -

The Guv'ment Is Selling Money Now Too

By JayBallentine in forum Merchant Cash AdvanceReplies: 3Last Post: 01-07-2014, 06:01 PM -

Taxmageddon and Selling Your Business 2012-2013....

By MCAVeteran in forum Merchant Cash AdvanceReplies: 9Last Post: 01-02-2013, 04:10 PM

Reply With Quote

Reply With Quote