Results 1 to 25 of 63

-

03-26-2020, 01:29 PM #1Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

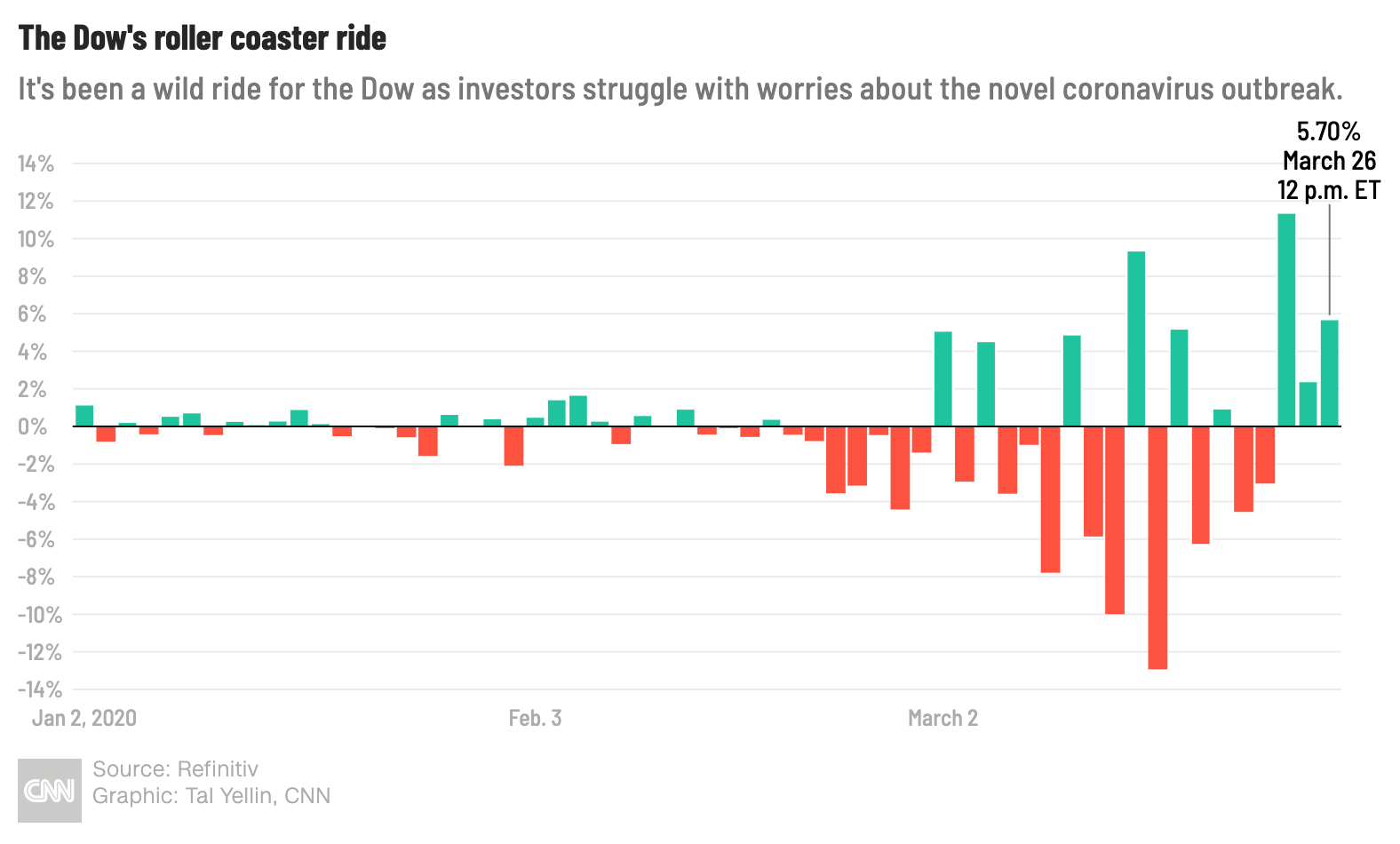

Any part-time Day Traders here taking advantage of the Covid-19 volatility?

Since I am in quarantine, I have had the time to day trade the market. I am not a professional in any way, but I have manage to hit 25% profit this week!

Anyone else day trading? Maybe we can share data on what stocks you are watching, what gappers you find, and what you feel is about to break out.

-

03-27-2020, 01:16 PM #2Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

Just to be transparent... I did give up a a little bit of profit today but still finishing up 23% for the week. With all that's going on it feels good to win on this front and be looking forward to see what the market does on Monday.

-

07-03-2020, 02:07 PM #3Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

C'mon, I know some of you all are trading! If we share info we can trade even better...

On this post here, I felt really good about Paypal, and said I was going to buy..... april 13th I bought 50 shares at $106, today its $177.. plus I have sold it and bought it a few times during this same time period to take profits on gaps up, then repurchasing at the bottom of a correction..

Share some of your winners...!!!

Currently, I am feeling BlackBerry Ltd NYSE: BB, is ripe for a buyout! It's currently at $4.85... I am purchasing 5k shares.. looking at the charts there is not a huge downside potential but , but a very big upside.. I will put my stops in place to prevent any huge losses on my part... I am willing to hold it for a few months, but I will be watching it for gapping opportunities to sell, then repurchasing at the bottom of the corrections.. Let's Go ride the wave!Last edited by Winning; 07-03-2020 at 02:37 PM.

-

07-03-2020, 04:05 PM #4Senior Member

Reputation points: 44858

Reputation points: 44858

- Join Date

- Apr 2019

- Posts

- 319

-

07-03-2020, 07:09 PM #5Senior Member

Reputation points: 158630

Reputation points: 158630

- Join Date

- Jul 2015

- Posts

- 1,202

This cat is now embarrassing himself using the tactics of some trading tips manual from 2009 he tripped over on the web while enjoying his bailout. HIT THE MESSAGE BOARDS and drop a symbol with an unattributed *ripe* spin. Pump it baby! Pump that ****!!

-

07-03-2020, 07:37 PM #6Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

Please, help me see myself.

I would like to follow your line of thought... I linked the post where I talked about buying PayPal a couple of months ago... How am I embarrassing myself? It kind of sounds like you are hating just a little bit.

In case you missed the link to the post.

https://dailyfunder.com/showthread.p...l=1#post139836

Where is the spin?

I also prefaced this thread with the fact that the trading stuff I do is only like a hobby, and due to the shutdown I have time to play with my hobby...

Again where is the spin?

Regarding if I did (or did not) trip over some info in 2009 that is beneficial to me or someone else what does that even matter?

That comment makes you sound a little bitter and sound like you are hating.

As I sit and think about your comment, what just came to mind was how the companies that received the huge bailouts in 2008, turned around and did stock buy backs with the bail out money! You remember that.... That was crazy....Last edited by Winning; 07-03-2020 at 08:34 PM.

-

07-03-2020, 08:14 PM #7Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

-

07-03-2020, 10:05 PM #8Senior Member

Reputation points: 44858

Reputation points: 44858

- Join Date

- Apr 2019

- Posts

- 319

haha, all good ..definitely learn now that everyone seems to have time and picking up new hobbies...just an fyi if you use robinhood for stocks its ok since its free and cool app whatever but if you plan on getting into advanced stuff like options,forex, etc try a more robust platform like think or swim or fidelity....robinhood can also support options but its not as good as the others imo, and just don't end up like that young trader on robinhood

https://www.marketwatch.com/story/fi...ebt-2020-06-14

-

07-03-2020, 11:19 PM #9Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

I actually use the TD Ameritrade think or Swim platform. They have tons of education... I remember when I 1st learned about stop-limit orders, thats been huge for me and have saved me from getting myself into to much trouble.

Do you do any day trading, or swing trading yourself?Last edited by Winning; 07-06-2020 at 09:40 AM.

-

12-08-2020, 10:06 AM #10Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

Haven't been around much, been really busy.. but just want to know if any of you also bought blackberry! It's crazy how sometimes I have these feeling about certain things... I called Paypal, and BlackBerry. Major win on both! Man what a rush! BlackBerry is currently at $8.40. This is unreal, like I am in the twighlight zone. Originally Posted by Winning;

Originally Posted by Winning;

-

12-09-2020, 05:10 PM #11Member

Reputation points: 33

Reputation points: 33

- Join Date

- Oct 2020

- Posts

- 9

I prefer crypto.

-

01-14-2021, 11:49 AM #12Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

BlackBerry breaking out again today! up 14% today!

-

01-15-2021, 09:35 AM #13Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

Wake up this morning, and it up another 24%! This cant be real!

-

01-19-2021, 09:45 AM #14Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

BB 12% on the day! I have never made this much return so quickly! What are the odds of me feeling this way about BB! I can't make sense of it...

As much as you all have given me over the years... I hope me mentioning BB here may have spurred someone here to look into BB and invest it in.

-

01-19-2021, 02:54 PM #15Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

5 hours later and its now at 21% on the day!!. Jesus christ... I just cant look away.. My fight or flight response has kicked in.. I feel nervous and shakey for some reason...

-

01-25-2021, 09:36 AM #16Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

BB still is gaining! Today it opened at $19! I am gaining so much, so fast on this I am now worried about my tax liability on the profits...

-

01-25-2021, 11:03 AM #17Senior Member

Reputation points: 39236

Reputation points: 39236

- Join Date

- Oct 2014

- Location

- Naples, FL

- Posts

- 470

BB... really??! Great call "Winning"! Wow... celebrating that one for you!

-

01-25-2021, 12:21 PM #18Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

I am in a state of disbelief myself! Blackberry themselves has issued a statement saying that they don't know WTF is going on with their stock prices.. I don't know if I should close all my current positions or what...

Originally Posted by Dow Jones Newswires

Originally Posted by Dow Jones Newswires

-

01-27-2021, 01:57 PM #19Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

BB breaking out right now. $27.50 per share!

-

01-27-2021, 03:48 PM #20Senior Member

Reputation points: 301165

Reputation points: 301165

- Join Date

- Jun 2015

- Posts

- 3,312

barely do stocks but just made nice money on gamestop , what is your next prediction

-

01-27-2021, 03:48 PM #21Senior Member

Reputation points: 39236

Reputation points: 39236

- Join Date

- Oct 2014

- Location

- Naples, FL

- Posts

- 470

...it seems that MAIN STREET is going against WALL STREET. Looks like millenials are committing a virtual armed robbery.

https://finance.yahoo.com/news/short...111100682.html

-

01-27-2021, 03:55 PM #22Senior Member

Reputation points: 337126

Reputation points: 337126

- Join Date

- Mar 2015

- Location

- Rock Ridge

- Posts

- 3,459

Ahhhhh...Day Trading.....that old game is back...... I have seen a lot of guys go flat broke day trading.

Hedley Lamarr......That's Hedley

-

01-28-2021, 10:16 AM #23Senior Member

Reputation points: 39236

Reputation points: 39236

- Join Date

- Oct 2014

- Location

- Naples, FL

- Posts

- 470

-

01-28-2021, 10:16 AM #24Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

The Gamstop thing is crazy! I didn't take any postions my self... I could have bought it at $80 after it ripped to $150, but thought it was over.. Then then next day it rips to $300... I personally know people that have made over $10,000 profit on Gamestop in a 24 hour period... There is a daytrader I follow on youtube that livestreams his trade and he profited +$200K on gamestop. https://www.youtube.com/watch?v=TyrmhoO-01M

Looks like the trading platforms are trying to prevent this from happening

Originally Posted by Dow Jones Newswires

Originally Posted by Dow Jones Newswires

-

01-28-2021, 10:27 AM #25Senior Member

Reputation points: 30747

Reputation points: 30747

- Join Date

- Aug 2016

- Posts

- 486

After people I personal talked to made huge gains on Gamstop, yesterday I took some small positions on Nokia (invested $300) and AMC (invested $300). My Nokia position is currently -31% and my AMC position is currently -38%..... God Damn FOMO got the best of me.

The things that the brokerages are doing to prevent the run up is working. I guess the short sellers are now reaping all the benefits. I think this is a very public display of just how rigged the system is.. This can become very bad for the stock industry. The optics just doesn't look good when the hidden hand that is always present shows up in such a public way.

Discord shuts down the Wallstreetbets server, the brokerages moving the goal posts, etc..

Just like the Tech industry kicked President Donald Trump off the internet, they can do the same thing to anyone or anything...Last edited by Winning; 01-28-2021 at 10:38 AM.

Similar Threads

-

who's still funding? during covid -19

By perceptioncapital in forum Deal BinReplies: 30Last Post: 10-13-2020, 02:37 PM -

who's still funding? during covid -19 NYC, FL , CA ???

By perceptioncapital in forum Deal BinReplies: 13Last Post: 04-11-2020, 11:41 PM -

What COVID is Really Doing Behind the Scenes

By Enablement Data in forum Merchant Cash AdvanceReplies: 1Last Post: 03-24-2020, 02:58 PM -

Take Advantage...

By ByzFunderDS in forum Merchant Cash AdvanceReplies: 5Last Post: 01-28-2020, 01:53 PM

Reply With Quote

Reply With Quote