The 20/20 on Business Lending

If the Money20/20 conference handed out medals for popularity, nonbank business financing companies would’ve warranted participation ribbons for showing up at best. Approximately 1% – 2% of the conference’s attendees would likely have identified themselves as a short term business lender or merchant cash advance company.

In a crowd of 7,500 financial professionals, business lenders were background noise, marginalized bystanders to the great fintech disruption table. Somewhere up in the merchant cash advance heavens Rodney Dangerfield probably looked around the conference and said, “I don’t get no respect!”

Even Bitcoin overshadowed business lending’s technological rock stars, but perhaps with justifiable reason. Bitcoins began to have value in 2010 and by the end of 2013, had a market capitalization of $13.9 billion. Contrast that against the relatively slow growth of the merchant cash advance industry, which produced only $3 billion in funding volume in its 15th year.

Even Bitcoin overshadowed business lending’s technological rock stars, but perhaps with justifiable reason. Bitcoins began to have value in 2010 and by the end of 2013, had a market capitalization of $13.9 billion. Contrast that against the relatively slow growth of the merchant cash advance industry, which produced only $3 billion in funding volume in its 15th year.

And while bitcoins have lost a lot of their value, they still currently have a market cap of $4.6 billion. Not bad for an intangible currency run by nobody and created by an anonymous elusive legend known only as Satoshi.

Bitcoin for all its mystery and criticism has sex appeal. Today’s nonbank business lenders have a sleepier message, broadly summed up as, “we lend when the banks won’t.” It’s the communiqué that Champion started broadcasting to America more than two decades ago through Joseph P. Goryeb. “When your bank says no, Champion says yes,” Goryeb intonated in the famous TV commercials.

24 years after those commercials started airing, nonbank business lenders are trying to repackage that familiar message to a different target audience. Their technology, data, and high costs allow them to say yes when the banks say no. Sounds logical enough, but is it disruptive on the wider economic scale?

Sizing it up

The annual funding volume of the merchant cash advance industry is about equal to the amount of assets a medium-sized hedge fund has under management or the loan volume that Lending Club is producing all by itself in 2014.

All funding volume estimates are exactly that, estimates, with no authoritative reports to back them up. So while prospective investors love the industry because of the attractive yields, analysts must resort to old fashioned detective work if they want to crunch numbers. Getting the inside scoop on merchant cash advance means knocking on doors of ISOs and funders scattered around the lower half of Manhattan.

Word on the street was that the industry funded $3 billion in 2013, which will expand to $4 to $5 billion this year in 2014.

Sex appeal

Meanwhile at Money20/20, independent Bitcoin publications flooded the exhibit halls with various informational guides and hard numbers. And if that wasn’t enticing enough, Bitpay had their bear mascot running around the show floor handing out high fives.

Meanwhile at Money20/20, independent Bitcoin publications flooded the exhibit halls with various informational guides and hard numbers. And if that wasn’t enticing enough, Bitpay had their bear mascot running around the show floor handing out high fives.

Nonbank business lenders have work to do if they want to raise their profile. A recent campaign by Kabbage is a step in the right direction. The Bitpay bear is no match for Puddles the Clown.

Keep on the corporate side, always on the corporate side…

The industry’s future may not lie in saying yes when banks say no but in celebrating entrepreneurialism itself.

LendVantage is certainly making a push in that direction through a sponsorship with America’s most watched entrepreneur TV show, Shark Tank.

And then there’s OnDeck which dominates nonbank business lending in name brand recognition but is often misunderstood and chastised by its competitors. A successful IPO may not only change the game for them, but increase the profile of the rest of the industry they’re part of.

The verge?

Money20/20 was an indication that something needs to budge. The daily payment methodology that so many nonbank business lenders leverage will soon be heading into its 17th year. Daily payment is about as new as Google or Amazon. Disruptive technologies and companies such as Uber are overthrowing long established industries in a matter of years. That’s the narrative of disruption, something that a product like merchant cash advance hasn’t done.

And maybe that’s okay. The commonly held belief that nonbank business lending was borne out of the Great Recession is a myth. Small businesses seeking less than $150,000 have been an underserved market for decades. The challenge hasn’t been about stealing customers away from banks but teaching prospective customers that they can actually get financing if they want it. In other words, these small businesses were nobody’s customers. And from 1998 to 2010, the market experimented with solutions.

But prior to 2010, the technology required to scale wasn’t there yet. Nonbank business lending and merchant cash advance financing were entirely powered by human labor. Then came big data, the algorithms, APIs, and the tech obsessed crowd of Silicon Valley to the rescue.

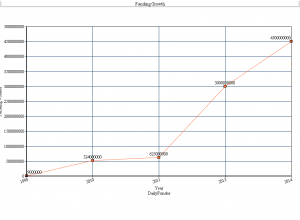

Look at the growth of financial companies utilizing daily payments between 1998 and 2010 and then 2010 and this year.

1998: $9,000,000

2010: $524,000,000

2014: $4,500,000,000 (estimate)

In other words, the industry didn’t really exist until 2010, around the time Bitcoin also became technologically feasible.

And oddly enough, today’s Bitcoin’s market capitalization is about equal to this year’s annual funding volume.

Nonbank business lenders may have been underrepresented at Money20/20 but the math says they’re not lagging behind. The growth curve since 2010 signals a wild uptick and a wave of something that could potentially and eventually be categorized as disruptive.

Saying yes when banks say no may not be sexy, but a market that’s never been tapped before that’s grown more in the last year than it did between 1998 and 2010 is something to get excited about.

While background noise in many regards, all the major industry players showed up at Money20/20. Perhaps next year they’ll get some respect…