The Free Alternative Business Lending Conference That Never Ends

My friends and colleagues peppered me with questions upon my return last month from the Transact 14 conference in Las Vegas. It was the same song and dance that everyone probably faces when they get back to the office.

“Was it worth it?”

“Who was there?”

“Did you have a good time?”

“Did you get any business from it?”

People want to know if spending $5,000, $10,000, or more is worth its weight in new business relationships. Sometimes the answer is yes. Other times it’s no. It takes a lot of skill and a little bit of luck to come out successful. It’s like a highly evolved game of poker.

Many of the big name funding providers in merchant cash advance and alternative business lending complain that it’s hard to meet new ISOs at these conferences. The little guys do the math and realize they can’t afford to go or they simply don’t have the time to fly across the country for a week of schmoozing and boozing.

Nobody wants to leave the office for a few days for a conference only to come back and find out that deals fell apart in their absence, especially if all they have to show for it is a swag bag full of pens, squeezable stress relievers, and brochures. But I digress…

There is value to be had by bringing folks from all across the industry spectrum into one central meeting place. Nothing has made me more sure of that than witnessing the results of a grand experiment that I kicked off back in 2012.

What if a trade show did not cost you money or time away from the office? And what if the exhibit hall hours were infinite so that you could attend at your leisure?

I’ve garnered much interest in the activity taking place on DailyFunder’s trademark forum. “Are people actually going to the site?” they ask. It’s one of those easy layup questions you’d be lucky to get from a potential advertiser you’re courting that can go horribly wrong if you respond with vague measures such as, “yes, everyone is going.”

But everyone is going, or at least almost everyone it would seem. More than 23,000 visitors in the first 3.5 months of 2014 had visited the site previously. The average time spent on the site for a returning visitor was 12 minutes. The average time spent on the site for a first time visitor was 5 minutes. Blended together, the average visit to the site lasts approximately 10.5 minutes. By contrast, Facebook commands an average visit of roughly 18 minutes. That would mean that folks who have visited DailyFunder more than once spend 66% of the amount of time on DailyFunder as they do on Facebook.

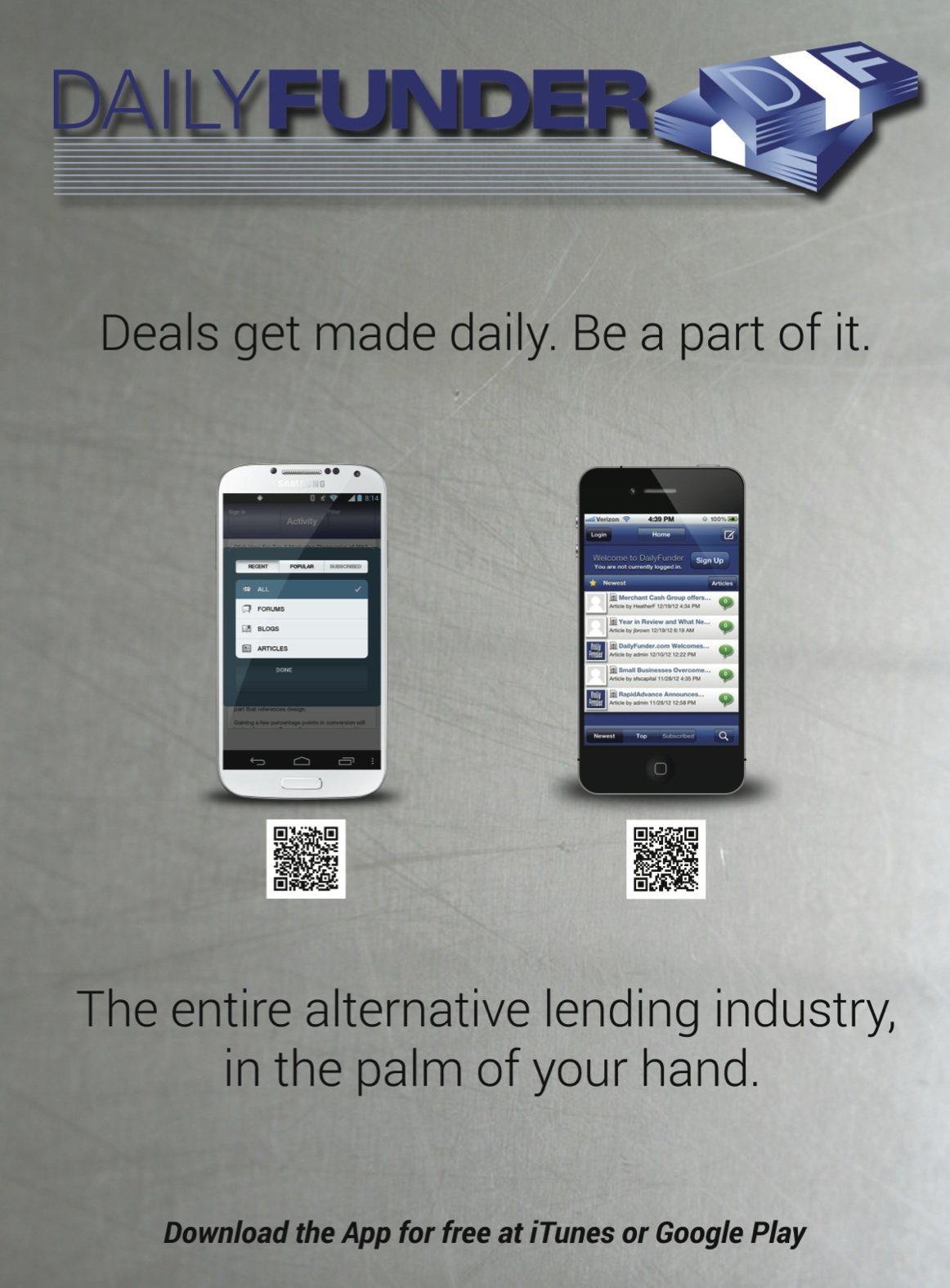

None of the above figures reflect our mobile device application usage, which has experienced a surge in activity. We just recently surpassed 90,000 monthly mobile ad impressions collectively through the iPhone and Android apps. 90,000 in a single month for an app that only shows a single ad at a time is an incredible opportunity for those interested in reaching a highly targeted niche audience.

There’s no shortage of information and discussion to soak in on the forum, as the site has amassed more than 5,500 posts across nearly 700 unique threads. If you need to know the who, what, where, when, why, and how of alternative business financing, you can find someone there that has the answer or has posted about it already.

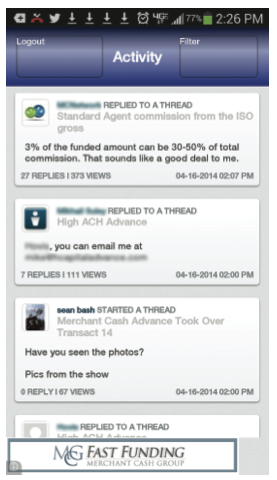

By far and away the best kept secret is the Activity Feed, the screen that allows you to monitor all the new content being posted to the site in real time without having to manually refresh your browser.

Whether it’s discussions about commissions, underwriting, or good old-fashioned industry drama, the Activity Feed allows you to miss none of it. For me personally, scrolling through the Activity Feed on my Android app is the last thing I check before I go to bed each evening and the first thing I check when I wake up.

Notably, seven big industry captains have contributed content to the site over time through the CEO corner, including Jeremy Brown (RapidAdvance), Andrew Reiser (Strategic Funding Source), Steve Sheinbaum (Merchant Cash and Capital), John D’Amico (GRP Funding), Scott Griest (American Finance Solutions), Ryan Rosett (RetailCapital) and Craig Hecker (Rapid Capital Funding).

The site has been fortunate to be linked to from the Wall Street Journal, New York Times, Bloomberg BusinessWeek, and other powerful media outlets.

You don’t have to create a user account to benefit from the experience, but there is a lot to be gained by doing so. Many visitors are doing what they’d like to do at trade shows, such as finding new strategic partners to work with, getting deals funded, and sharing tips. Site members tell me there’s a lot of business being made behind the scenes, whether through the site’s private messaging system or from the phone calls and emails that result from having their contact information publicly available on there.

Of course there are others that have set up virtual booths by taking advantage of online & mobile ad placement. In what is currently the only online event of its kind, big funders and small ISOs alike are finally all in the same place.

Tickets are free and the exhibit hall hours are forever. The activity and opportunities never end on DailyFunder.

Go to: Previous page | Next page

Go to: | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20